Is Putin Winning the War of Attrition With the US?

The news that President Donald Trump offered to hold a meeting with his counterpart in the Kremlin, Vladimir Putin, has the political world in an uproar.

Furiously keyboards are chattering away as laptop bombardiers are worried that perpetual war for perpetual empire will end if Trump and Putin see eye to eye on anything.

From the bowels of MI-6 to the think tanks that line K Street schemes are hatched to make it politically unacceptable for Trump to do what he apparently did, if TASS is to be believed.

If true, the offer represents the biggest shift in U.S./Russian relations since Trump’s election and the subsequent hissy fit thrown by his political opposition in every corner of the political landscape.

Because they know what’s happening even though you could never get them to admit it in public, the U.S. is vulnerable.

We’re not vulnerable in any ultimate weapons sense. The U.S. can certainly lob enough nukes at Russia to wipe them out and vice versa. No, we are vulnerable where our real power comes from: our dominance of the world’s capital markets backed up by both the political will to isolate anyone who doesn’t toe our line and/or the military might to put down any marginal challenges.

Real Might, Real Power

So, China finally launching an oil futures contract denominated in Yuan, the so-called petroyuan, and convertible to gold is a financial WMD which doesn’t dwarf Putin’s new hypersonic missiles today. But, over time that weapon will grow in power and destructive capability.

China is the world’s largest importer of oil. That makes it the source of marginal demand for oil in the world. Russia is the world’s second largest oil exporter, that makes them one of the suppliers of the marginal barrel of oil on the world market.

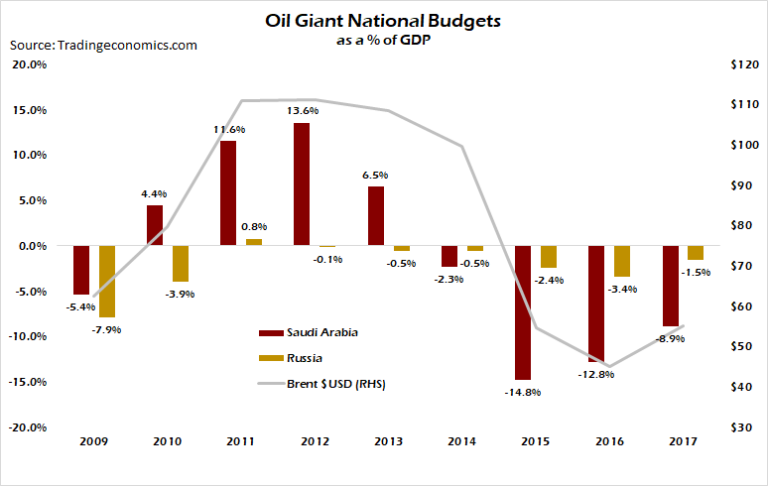

While the Saudi Arabians export a lot more oil than Russia, they do so at a much higher all-in-sustaining-cost basis than Russia does (see volatility of the Saudi Budget relative to oil prices below). At current oil prices Russia’s slowly growing economy is capable of meeting its social needs as measured by the government’s budget, which ran a very modest 1.5% of GDP in 2017 and should contract again this year.

On the other hand the Saudis ran an 8.9% budget deficit in 2017 and has zero hope of closing that much further without higher oil prices. The Saudis are simply at the mercy of the oil price.

Therefore, the Russians are, in my opinion, the producer of the marginal barrel of oil because of their greater economic diversity.

Economically speaking, the marginal supplier and marginal buyer set the price. No one else does.

And when you are the marginal buyer you decide what currency you’ll pay in. In the 1970’s when the U.S. was so “dependent on foreign oil” we were also the price setters. This was the framework for the petrodollar deal. Saudi Arabia got U.S. cover for its crimes against humanity and the U.S. got to export dollars around the world and build up confidence in our government bond markets.

Today China is where the U.S. was and it’s position is getting stronger by the day. And that’s why this petroyuan contract can and will succeed where others have failed in the past.

At some point China will tell the Saudis they no longer are willing to subsidize the U.S. dollar and offer up only Yuan in payment.

And guess what folks? The Saudis will play ball. So will the U.S.

If they don’t China will continue to buy more and more oil from Russia who will be only too happy to accept Yuan in payment for services rendered. The Saudis will see their power eroded over this. The dollar will fall as a percentage of reserves.

The Waiting Game

And this brings me to Putin and his near infinite patience. It is easy to have patience with your opponent when you know your opponent has no end-game strategy other than war.

Putin understands that the U.S. is living on borrowed time. That moves like this ‘petroyuan’ contract are the beginning of a new landscape.

When Chinese banking giant ICBC bought a London Bullion Market Association vault, a seat on the fixing board and became one of thirteen market makers we all wondered what the end game was. But, it should be plainly clear now.

The LBMA is the means by which China can make good on its promise to back its Shanghai Oil Futures contract with gold, allaying the fears of institutional investors and traders of an exit strategy for their profits.

China gets a way to deepen its yuan-denominated debt markets and expand the Yuan’s base via organic growth of demand for it as a trade settlement currency. Investors are safe knowing they can hold yuan-denominated debt because it is convertible to gold as a hedge.

The Russians get a willing partner with tremendous capital reserves to invest in Russia and benefit from the growth of their relationship. Russia gets to diversify its reserves and lessen the impact of an exchange rate shock between the ruble and the U.S. dollar.

Putin knew the Chinese were making the right moves to pull off what marginal players like Qaddafi in Libya and Saddam Hussein in Iraq could not do, defy the U.S.’s control over the pricing of oil.

The petrodollar is the U.S.’s Achilles’ heel. Trade matters despite Martin Armstrong’s downplaying of it. It is the basis on which an economy can or cannot sustain a virtuous credit cycle in our absurd fractional reserve banking system.

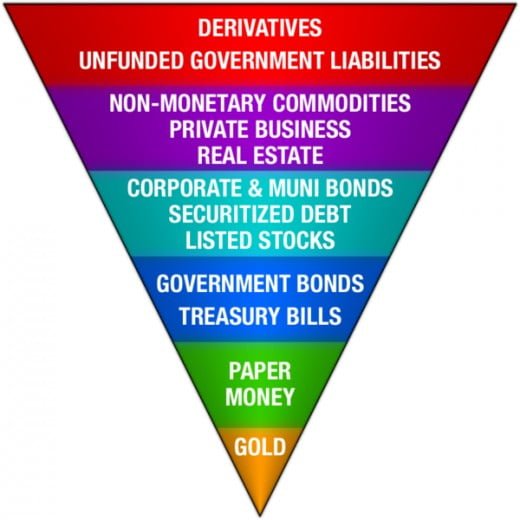

It is the M-zero of the international monetary system, as it were. And if anything about central banking is to be believed, shrinking a particular currency’s portion of global M-zero means shrinking its multiplier through asset valuations, c.f. Exter’s Pyramid.

Because of this the petrodollar is one of the main conduits that allow us to finance our current spending habits. If the U.S. only ran a trade deficit, then Triffin’s Paradox would be in play and the current system would be sustainable for a lot longer than it is today.

But with the fiscal and demographic nightmare unfolding in the U.S. and Europe all Russia has to do is deflect the worst of their aggressions while waiting for time to catch up with their profligacy.

And that time is catching up with us rapidly.

And that’s been Putin’s plan all along. Simply win a hybrid war of attrition with the U.S. and Europe. Trump, I think, understands this, though he’d never admit it in public and nor should he.

The very fact that he’s willing to meet Putin now after a deadly clash between U.S. forces and Russian mercenaries in the oil fields near Deir Ezzor and Putin’s unveiling weapons that render moot much of the U.S.’s current defense spending means he knows it’s time to begin pulling the world back from the brink of catastrophe.

That Trump made this offer despite the virulent protestations of the foreign policy wonks in his cabinet (many of whom he recently fired) and the chattering class in Congress and the Media speaks to how serious the situation truly is behind the scenes.

So, while I don’t believe this petroyuan contract will change the world now, it is another bit of leverage China has in its trade and geopolitical negotiations with Trump over Iran, North Korea, Syria and China’s One Belt, One Road project.

Putin’s very prudent means of getting Russia’s own house in order put her in the position to outlast the U.S. who will, over the next few years have to retreat or destroy the world.