China Will Buy Turkey On the Cheap

Like the fall of the Ottoman Empire after World War I, Turkey’s present financial collapse has been expected for years. The sloth of credit rating agencies and the laziness of bank credit committees allowed Turkey to struggle on a year or two longer than it should have, but the collapse of the Turkish lira this week after a long, sickening decline surprised no-one.

Turkey’s volatile president Recep Tayyip Erdogan might have put off the crisis, but instead decided to butt heads with US President Trump over the arrest of an American Protestant minister for alleged terrorism.

At 9:20 am Eastern time, Turkey’s lira was trading at 6.5 to the US dollar, or less than a third of what the currency was worth in 2014. Turkey’s economy is headed for extreme levels of inflation as the price of imports jumps, amid a severe contraction of output as the cost of production inputs rises out of the reach of Turkish businesses.

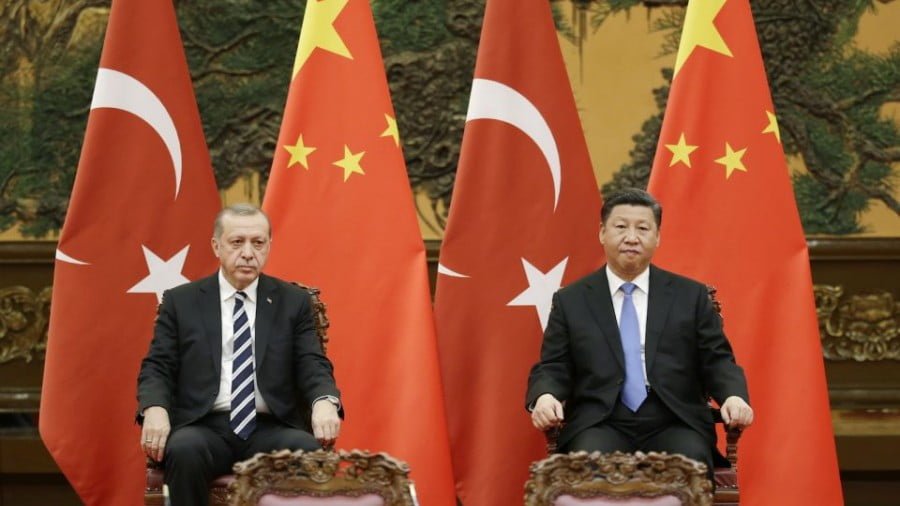

Turkey will end up as “an economic satrapy of China,” as I predicted last November. President Erdogan in effect threw himself on the mercy of China in a barely-coherent speech earlier today.

Turkey’s economy is likely to shrink by 10% to 20% before the bleeding stops, as I predicted June 12. Erdogan’s supposed economic miracle followed the old formula of Third World kleptocracies of the past, namely massive domestic credit issuance supported by massive foreign borrowing. Turks bought foreign consumer goods with the proceeds and the country’s current account deficit swelled to 6.5% of national output. That’s close to where the Greek current account deficit stood in early 2012 when the country’s economy imploded.

Turkish companies have borrowed roughly US$300 billion in foreign currency, and now have to repay it in devalued Turkish lira. Most of the debt was issued when the Turkish lira traded at less than 2 to the dollar. It now trades at more than 6 to the dollar, so the cost of debt service has tripled for Turkish borrowers with local-currency earnings.

Some of the lending was financed by Turkish banks who borrowed dollars or euro from other banks in the short-term interbank market and lent them to their customers. If Turkish banks can’t roll over their interbank exposure, the Turkish banking system will collapse. That won’t happen because Spain’s BBVA owns Turkey’s largest bank, Garanti.

The last time the Turkish lira blew up back in 2001, the country went to the International Monetary Fund for a loan and accepted strict austerity conditions in return for the bailout. Erdogan is unlikely to do so. In a rambling speech to supporters today, he said that Turkey was exploring alternatives with China, Russia, and Iran. Earlier in the week, Erdogan said that Turkey would issue so-called panda bonds in China’s local-currency market.

That’s just the door prize, judging from commentary on China’s English-language television channel CGTN. The Chinese broadcaster quoted Turkish economist Emre Alkin: “Stability for the Turkish Lira will come from cooperation with valuable countries like China. It’s impossible for the Central Bank to do something alone, resources are needed. If this resource will come from China, then it will come from China, but the important thing is to make use of this resource. It is clear we need the wisdom, the ideas and the suggestions of countries like China.”

Turkey will have to sell some of the state’s most important assets. With the Turkish lira trading at 6.26 to the dollar, the whole of the Istanbul 100 equity index is worth just US$35 billion. If Chinese investors were to buy every share of every company on the stock index, Turkey would raise enough foreign exchange to cover just seven months of its current account deficit. Turkey will have to sell a great deal more than its publicly traded companies to raise the money it requires, and it will also have to tighten its belt drastically.

Altay Atli, a Turkish economist and past contributor to Asia Times, told the Chinese television station that Turkey will offer China more partnerships in its ports and other transportation infrastructure. China’s state-owned shipping company COSCO Pacific already owns 65% of Turkey’s third largest port. Atli said, “I believe Turkey and China could also expand their partnerships in Turkey’s other ports, in the Mediterranean Sea, in the Aegean Sea, and at the Black Sea. And a critical move is not just to combine these ports with railway projects and extend the lines, but to create a logistical network.”

China has the opportunity to undertake the Sinification of Turkey at low cost. China’s largest telecom equipment company Huawei already is working on 5G Internet with Turk Telecom, in a deal covering cloud computing, the Internet of Things and – most importantly – public security. Alibaba, China’s answer to Amazon and Google, invested earlier this year in Turkey’s e-commerce platform Trendyol.

The combination of mobile broadband, rail and sea logistics, e-commerce and e-finance will absorb Turkey into the greater Chinese economy. Not long from now containers of Chinese-made parts will arrive by rail in Anatolia for assembly into finished products to be sold in Europe and the Middle East.

President Erdogan will be able to shake his fist at Washington and talk of Turkish national pride, while turning his country into a satrapy of China.