Trump Just Triggered a New Financial Crisis. Here’s Why

Trump’s attack on the Turkish lira, combined with recent Federal Reserve moves to choke off dollar supply, is pushing the world towards a re-run of the 1997 currency crisis. This may well be the whole point.

Last Friday, Donald Trump announced new sanctions on Turkey – comprising a doubling of the steel and aluminum tariffs he had introduced earlier this year. Turkey’s currency was already struggling, but these new sanctions “are the straw that broke the camel’s back,” according to Edward Park of the UK investment management firm Brooks Macdonald.

The same day, the Turkish lira fell to more than six to the dollar, the first time it had ever done so, hitting a low point of 7.21 to the dollar on Sunday. Following Turkish caps on currency swaps, it slightly regained some of its lost value, and was trading at 6.12 by Wednesday, still way below the 4.75 to the dollar it was worth last week.

While the Turkish move has had some effect, this should not be overstated: simply banning the trading of lira above certain limits, which is effectively what Turkey has done, is hardly a sustainable means of revalorizing the currency; and according to the FT, investors “are still ratcheting up bets against Turkey in other ways, such as through credit default swaps that pay out in the case of a debt default.” Turkish bank shares now stand at their lowest level since 2003.

Underlying the currency’s vulnerability are the country’s massive dollar debts. Turkish companies now owe almost $300 billion in foreign-denominated debt, a figure which stands at over half its GDP. The question is – how did this happen, and why has it suddenly now become a problem?

During the era of quantitative easing (QE), the US Federal Reserve flooded US financial institutions with $3.5 trillion in new dollars, much of which poured into so-called ‘emerging markets’ such as Turkey. So long as the music kept playing, this was fine – near-zero interest rates, combined with a weak dollar, made these debts affordable. But since the Federal Reserve ended its program of QE last year – and then started to reverse it, selling off the financial assets it had purchased (and thus effectively taking dollars out of the financial system) – the dollar’s value has started to rise again, making debt repayments less affordable.

This appreciation of the dollar has been compounded by two successive interest-rate rises by the Reserve; but it has also been compounded by Trump’s actions. Paradoxically, Trump’s trade wars have led to a further rise in the dollar, as investors have viewed it as a ‘safe haven’ compared to other currencies deemed less able to withstand the unpredictable turbulence he has unleashed. Even the yen and the Swiss franc, traditionally viewed as ‘good as gold,’ have weakened against the dollar as, indeed, has gold itself.

As Aly-Khan Satchu, founder and CEO at Rich Management, has put it that the “US dollar has been weaponized – either deliberately or by design” (is there a difference?), adding that the “dollar is basically kneecapping countries,” warning that other countries will face the same treatment “if they continue to pursue the policies that Erdogan is seeking to pursue.”

Thus, Turkey has been hit by a quadruple whammy by the US – interest-rate hikes and the choking-off of dollars from the Fed; tariffs and sanctions from Trump. The result is a loss in the lira’s value of almost 40 percent since the start of the year.

The effects are already being felt far beyond Turkey’s borders; the South African rand fell to a two-year low on Monday, and the Indian rupee, Mexican peso and Indonesian rupiah have all been hard hit. This is unsurprising, as the ballooning of dollar-denominated debts – from $2 trillion 15 years ago to $9 trillion today, largely in the global south – combined with the reversal of QE, was a crisis waiting to happen. All the conditions which prefigured the 1997 east Asian currency crisis are now effectively in place. All that’s needed is a push – which is exactly what Trump has just given.

This is textbook stuff – or should be, if economics textbooks bore any relation to reality (which they don’t). The last 10 years are virtually an exact replay of the decade or so running up to the 1997 crisis. While the 1985 ‘Plaza Accord’ dollar devaluation was not exactly QE, it had the same intent and results – a flood of cheap money and dollar debt, and therefore growing global dependence on the dollar and vulnerability to US monetary and economic policy.

This vulnerability was then effectively ‘cashed in’ with the ‘reverse Plaza accord’ 10 years later, which, as with the current reversal of QE, choked off credit and ramped up interest rates, making markets more jumpy and bankruptcies more likely.

In the end, the trigger was the collapse of the baht – the currency of a country (Thailand) with a GDP half that of Turkey – which spiraled into a crisis that ultimately spread across all of Asia, sabotaging the continent’s development and allowing US corporations to buy up some of the most advanced industrial plant in the world for a fraction of its value.

It is not hard, then, to see why Trump and the Fed might well wish to trigger such a crisis today. The more the currencies of dollar-indebted countries slide, the more real goods and services they have to pay in tribute to the US to service the same paper-dollar debts – while those who cannot keep up will be gobbled up for pennies on the dollar.

However, beyond these purely economic gains lies also the geopolitical imperative – to maintain and extend US domination by scuppering its rivals. Trump is, after all, about nothing if not the conversion of all possible means of power into leverage to obliterate his opponents. Forcing one country after another to the brink of bankruptcy – and therefore to the IMF for a bailout – is a means of cashing in the dollar-dependency built up over the past decade into raw power.

One can easily imagine the demands that the US might make in return for its support in securing an IMF bailout – end oil imports from Iran, discontinue involvement with China’s Belt and Road Initiative… the potential is vast. Already direct threats are being made against Turkey about ‘what it needs to do’ to ‘reassure the markets’ – the Times on Tuesday, for example, demanding that “Erdogan should end his spat with the West if he wants to avert a deeper crisis… his course of action should be clear: he should raise interest rates [that is, promise a bigger cut of the Turkish economy to international currency speculators], heed competent economists, explicitly guarantee the independence of the central bank [that is, remove it from democratic oversight], and make up with President Trump” – as, after all, “US support will be needed if the IMF or World Bank is to step in.”

Indeed, it is here that the false dichotomy between the ‘globalists’ and the ‘economic nationalists’ in the Trump White House – and the country at large – is, once again, exposed. When it comes to pushing the global South into bankruptcy, their interests are perfectly aligned. However much Goldman Sachs’ press releases may cry wolf about Trump’s tariffs, the reality is that the trade war is the icing on the cake of the Fed’s own policy of squeezing the ‘emerging markets.’

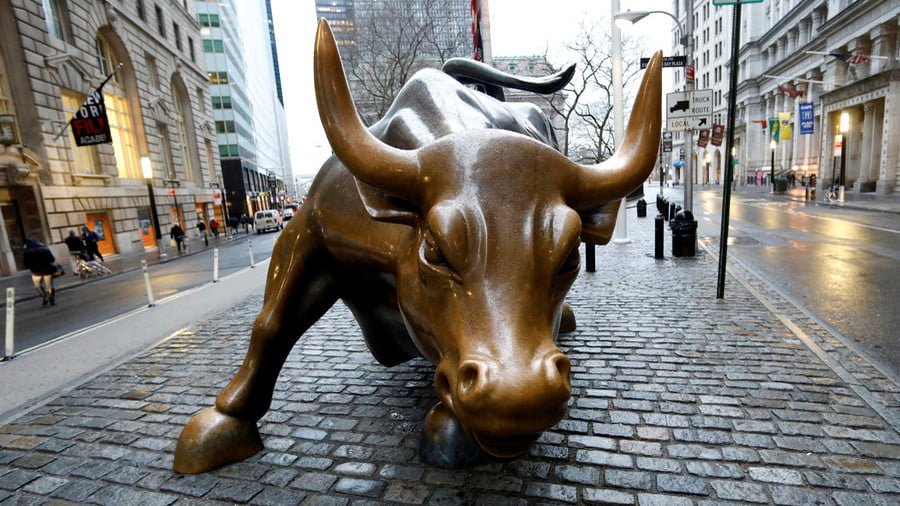

Wall Street depends on precisely the kind of financial instability which Trump’s trade wars have triggered. As Peter Gowan has noted, “the US economy depends… upon constantly reproduced international monetary and financial turbulence.” Meanwhile, Wall Street in particular “depends upon chaotic instabilities in ‘emerging market’ financial systems.” But by draping these actions in the flag, and parading them alongside a chorus of pseudo-shock from the ‘globalists,’ their true nature is obscured. The global south now stands on the precipice – with ‘establishment liberals’ and ‘nationalist insurgents’ alike lining up to give them a shove.

And it is the USA sanctions that are harming the Venezuelan economy (hyper-inflation), whilst the USA and the mainstream media blame the Socialist Government!