Trade War III – Third Time’s the Charm

The trade war will not result in bringing more business back to American soil: Just 6% of our member companies say this current US-China trade dispute would make them consider relocating operations back home.

William Zarit, Chairman of The American Chamber of Commerce in China.

This is America’s third trade war on China: we held its head under water from 1949-1971 and from 1989-92. Inter alia, the US, the EU and the USSR embargoed all weapons technology to prevent China from independently developing the H-Bomb or launching satellites. She did both and kept her economy growing debt-free, twice as fast as ours. This time, embargoes will have even less effect, for several reasons:

I. LABOR

President Trump observed, “China’s leaders are much smarter than our leaders and we can’t sustain ourselves like that. It’s like, taking the New England Patriots and Tom Brady and having them play your high school football team”. Even Henry Kissinger agreed, “The Chinese are smarter than us so my approach was to tell the truth upfront because they’d figure it out anyway”. Trouble is, they’re smarter all the way down.

PISA tests show their high schoolers graduating three years ahead of ours in STEM subjects and add to that their five point IQ advantage and you get a labor force comfortable in the 21st century. A friend, a director-level employee with an engineering background who has worked with multiple multinational companies in various capacities, but has been primarily based in the US sees it this way (his emphasis):

Most people don’t realize that the Toyota factory churning out cars has only half of its staff on the manufacturing floor. The other half is engineers and supply chain guys, supervisors etc…. the engineers at these facilities are responsible for fixing daily technical issues and working with R & D. The vast majority of modern manufacturing is done by machines.

American manufacturing moved to China not because of dumb labor, but because you could hire high IQ people for dirt cheap. If your machine broke down, no problem; some Chinese guy (with basically a masters in EE) would pull out the circuit boards and using probes and other instrumentation determine what board needed replacing and he would work annually for a fraction of the salary of his equivalent in the US.

Manufacturing in the US is a nightmare: at our facility our only requirement for a assembler was a high school degree, US citizenship, passing a drug and criminal background check and then passing a simple assembly test: looking at an assembly engineering drawing and then putting the components together.

The vast majority of Americans were unable to complete the assembly test, while for our facility in China they completed it in half the time and 100% of the applicants passed. An assembler position in the US would average maybe 30 interviews a day and get 29 rejections, not to mention all the HR hassles of assemblers walking off shift, excessive lateness, stealing from work, slow work speed and poor attitudes.

The product line is highly specialized equipment, so it makes no sense to fully automate it, most of the components are assembled by hand and for certain steps we use custom engineered jigs. And for those saying that the position wasn’t paying enough, it paid $12 an hour starting in an area with an extremely low cost of living where property taxes for a 2000 square foot house would be $800-$1000 a year. Assemblers don’t make $150K. An assembler takes parts and puts them together. The position starts at $12 an hour in flyover country which is pretty reasonable compared to other jobs that only require a GED and no prior work experience. Offers medical, dental and annual raises with plenty of opportunity to move up in the company. The national average salary for a Production Assembler is $33,029 in United States, which is what you would be making if you stayed for 5+ years.

Finding a black or Hispanic capable of passing these simple requirements and passing the assembly test is merely impossible nevermind being competent, punctual and of good moral character (not stealing from company or starting conflicts with coworkers). And these are the main groups that apply for this position. The same exact product line has the same facility in China, and the same positions in China pays the same wages as other positions there with only a high school degree and no work experience. Yet the applicant quality is much higher, and this applies as well to the white collar professions that support the manufacturing: schedulers, quality inspectors, equipment testers and calibrators, engineers, supply chain managers, account managers, sales etc….their labor quality is simply higher. I suspect the blacks and Hispanics are probably too dumb to get affirmative action too dumb to go to college, so they probably average 75 IQ and their Chinese equivalents are probably 95 but the performance gap is massive.

The equivalent position, with the same requirements is present in all countries, with corresponding wages. There is no shortage of applicants in most countries, but in the US the younger candidates routinely fail the exam while in China they routinely pass. The US has a higher proportion of unfit workers than China. Statistically, people that don’t have college degrees apply to this job (and statistically blacks and Hispanics are less likely to have college degrees so the bulk of applicants are black and Hispanic). Likewise in China, the people who typically apply for these positions are high school grads who failed to score enough on the Gao Kao (China’s version of the SAT) and thus unable to gain acceptance into a university.

There’s a reason why all the tech CEO’s and high level management employees are convinced they can’t replace China and its not because they want to make more profits. At the end of the day, high-end and middling manufacturing is not moving to either the US or Mexico because the average person in flyover country and Mexico are dumb as rocks. And anyone praising Mexico is not upper management and there is a very good reason why Mexico’s economy stagnated until NAFTA which basically was nothing more than a scam to rebrand things manufactured in other countries ‘Made in Mexico’ and export them to the US to avoid tariffs. If Mexico was a competent country with quality workers the laws of economics would magically reroute supply chains without trade wars, tariffs or free trade agreements and likewise the same applies for every 3rd world sh1thole like India or Somalia.

Companies choose eastern Europe and China for high IQ, work ethic, competence combined with lower wages.

2. DEBT

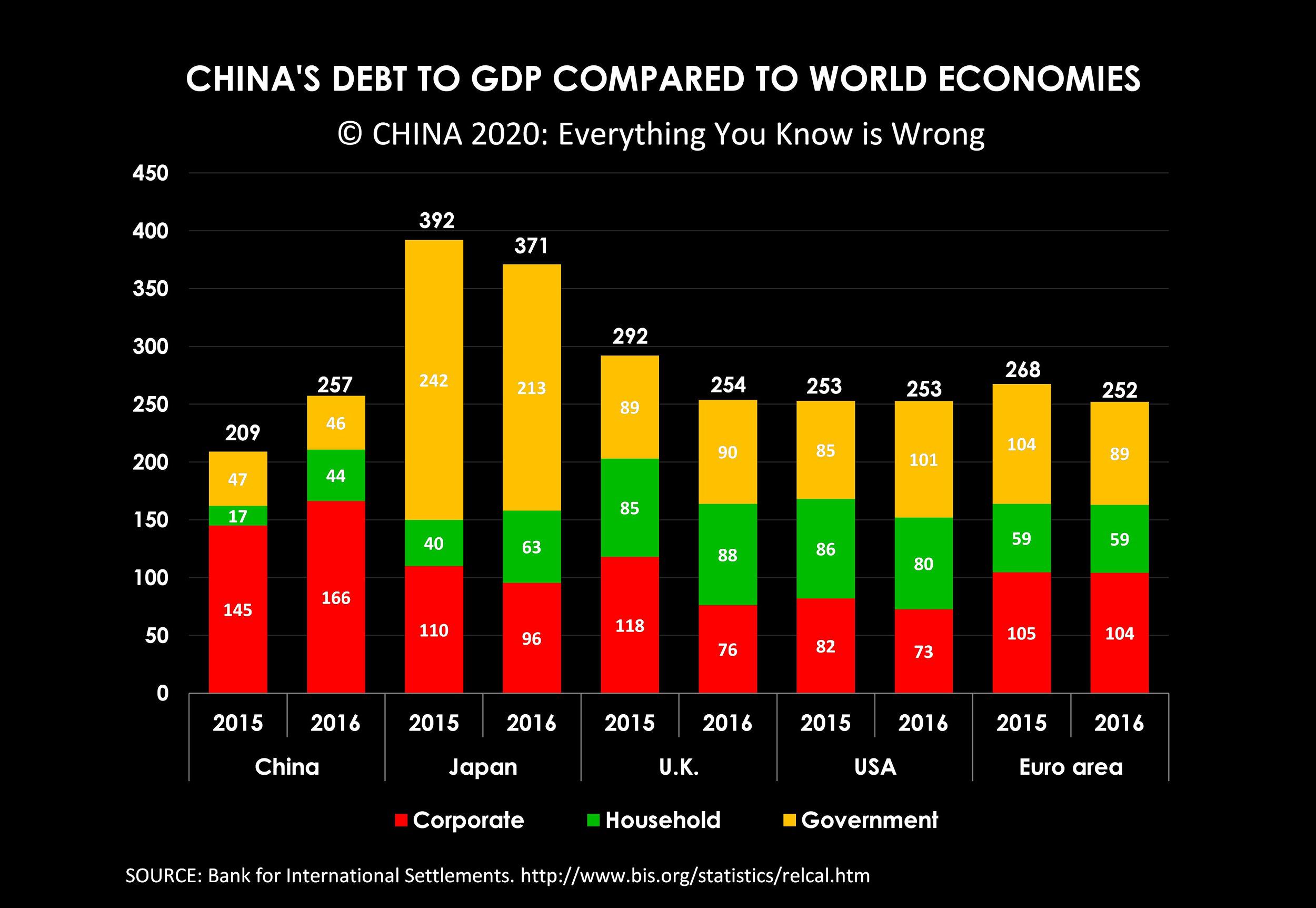

As part of our media’s ‘extend and pretend’ approach, things are bad in China and debt is high on the list of looming catastrophes which a truly just God should have inflicted on the heathen country by now. But the facts say otherwise–and China’s debt is mostly between government departments in an economy growing three times faster than ours.

3. CURRENT ACCOUNT SURPLUS

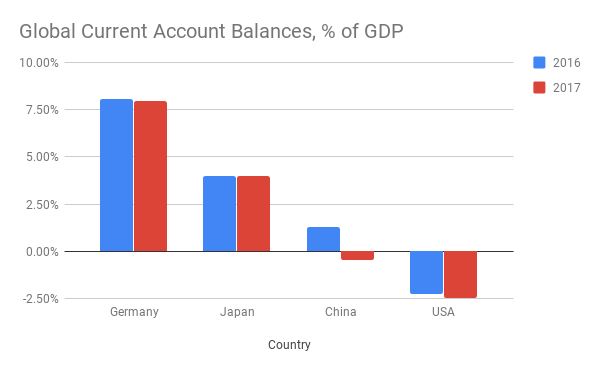

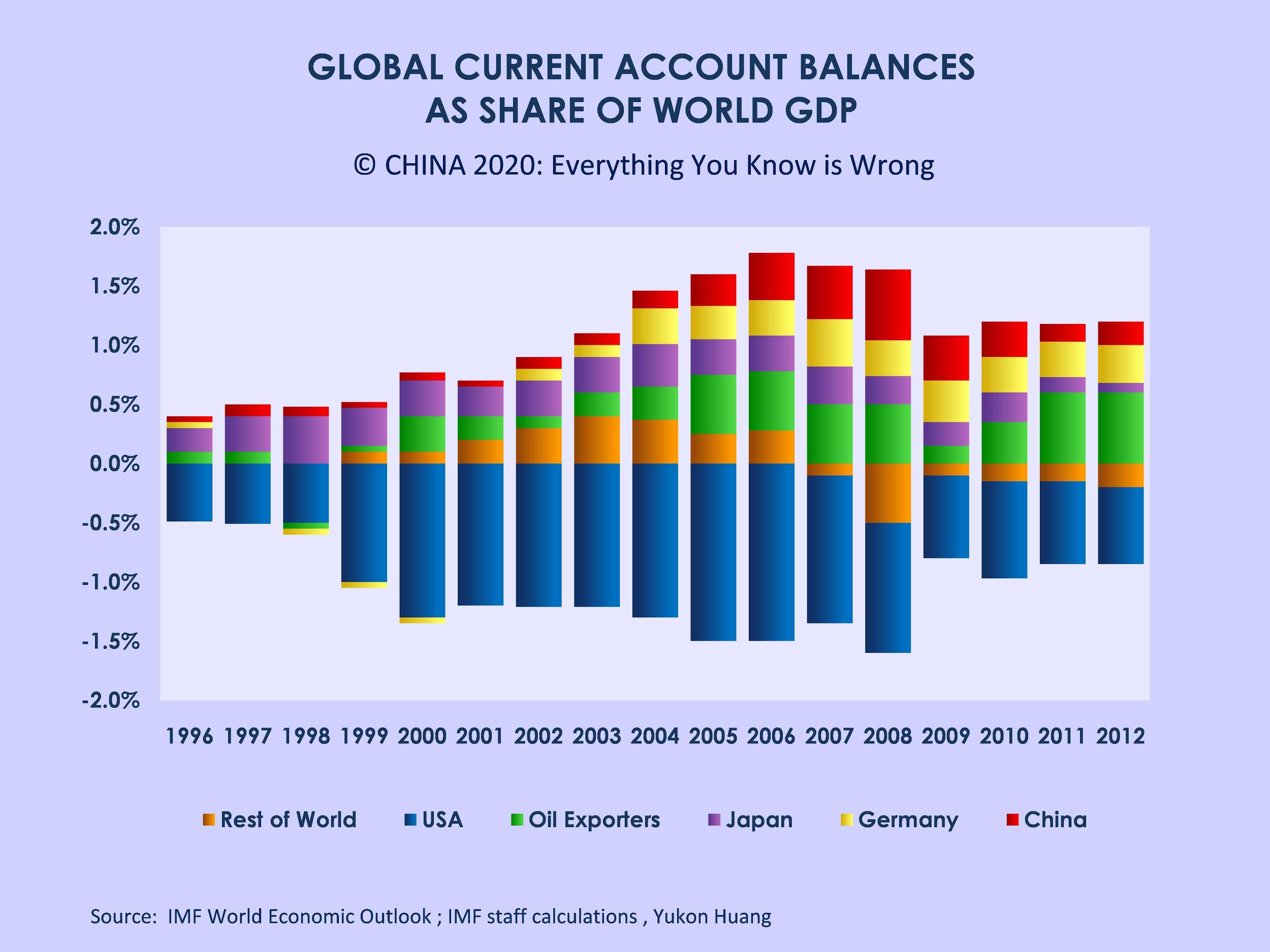

Both countries’ current account are negative, America’s more so.

4. TRADE DEPENDENCY

Trade comprises 13% of our GDP, 18% of China’s and 43% of the EU’s. China’s balance of trade (imports vs exports) has remained between -2% and -3% since 2007 and is currently in almost perfect balance and trade with the US contributes 2.5% to her GDP. America’s balance of trade has remained between -1.5% and -0.5% since 2007 and trade with China contributes 1% to America’s GDP, suggesting that our deficit reflects our low rate of domestic saving and a high rate of federal borrowing. Ceteris paribus, if China-US trade falls by (an extreme) 20%, China’s GDP will drop by 0.5% and ours by 0.2%.

5. OPERATING ASSUMPTIONS

When we we deputized the Chinese to do our dirty manufacturing and recycle our trash decades ago our media hailed the move as inspired and, for a while, we felt like winners. Now that era is ending, we’re in denial and President Trump’s China man, Peter Navarro, reflects our media’s unwillingness to confront reality in his academic paper, The Economics of the ‘China Price’. He asks, “How has China been able to emerge as the world’s factory floor?” and answers, “ The answer lies in the eight major ‘economic drivers’ of the China price:

- Low wages,

- Counterfeiting and piracy,

- Minimal worker health and safety regulations,

- Lax environmental regulations and enforcement,

- Export industry subsidies,

- A highly efficient “industrial network clustering”,

- The catalytic role of foreign direct investment (FDI),

- An undervalued currency”.

Since his analysis informs the President’s policy, let’s look a little closer:

Low wages? Adjusted for productivity, benefits, etc., Chinese workers cost their employers as much as their American cousins and their wages are doubling every decade and 450,000,000 urban Chinese will have higher net worth and more disposable income than the average American by 2021.

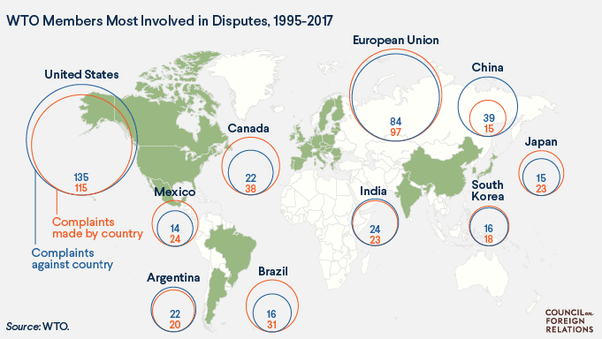

Counterfeiting and piracy? Our media has long promoted this canard whereas in fact China is ahead of us in most areas. It is the most influential country in four of eight core scientific fields–computer science, mathematics, materials science and engineering (more than 70% of academic patent families published in quantum information technology since 2012 have been from Chinese universities. US universities are second with 12%). China also leads the world in research, development and deployment in all fields of clean energy and most fields of civil engineering, manufacturing, supercomputing, speech recognition, graphenics, thorium power, pebble bed reactors, genomics, thermal power generation, quantum communication networks, ASW missiles, in-orbit satellite refueling, passive array radar, metamaterials, hyperspectral imaging, nanotechnology, UHV electricity transmission, railway engineering, electric vehicles, radiotelescopy, hypersonic weapons, satellite quantum communications and quantum secure direct communications. Court records in the WTO’s TRIPS database, in San Jose, Shanghai and Beijing (where Apple is currently suing Qualcomm) record no theft of significant technologies. Buyouts, IP transfers, indigenous development and and $30 billion in annual licensing payments account for 99.9% of China’s IP.

Minimal worker health and safety regulations? Chinese labor unions, whose 130 million members outnumber the rest of the world’s combined, have thus far persuaded the government to ratify four of eight UN Labor Conventions (the US has ratified two), two of four Governance Conventions (the US, one) and twenty-two of 177 Technical Conventions (the US, eleven). The Labor Contract Law permits employers to unilaterally terminate employees, with severance, only if they remain incompetent after training or reassignment and, since labor courts interpret them strictly, employers who defy labor laws invariably suffer adversely. Even the Voice of America admitted, “In 1995 China enacted a labor law granting all workers the right to a wage, rest periods, no excessive overtime and the right to carry out group negotiations. Beijing, hoping to push local authorities to address the situation, issued a notice to local governments to make improving labor relations an ‘urgent task’ and work to ensure employees are paid on time and in full, launch programs to provide better labor protections for rural migrant workers and call on employers to improve workplace safety. Although many labor protesters have been detained, few have been criminally prosecuted”. Conditions in Chinese factories are generally better than those in equivalent factories Stateside.

Lax environmental regulations and enforcement? China’s environmentalregulations are as strong as America’s and enforcement will overtake ours within two years. If that sounds far fetched, compare the draconian powers of their new Environment Ministry and the number environmental offenders they have prosecuted and jailed.

Export industry subsidies? The public record shows China has honored far more of its WTO agreements than America.

A highly efficient “industrial network clustering”? Adding clustering to high quality employees makes manufacturing in China very sticky.

The catalytic role of foreign direct investment? A.T. Kearney says the US and China attract the same level of FDI.

An undervalued currency?Our trade deficits are caused not by an undervalued yuan but by a seriously overvalued dollar, caused primarily by excessive foreign demand for dollars and dollar-based assets.

China’s currency has been fairly valued for years against a weighted basket of its trading partners’ currencies and has stayed comfortably within its trading band. The value of the dollar fluctuates far more than the value of the basket.

If China were guilty of currency manipulation as defined by the IMF, it would run significant current account surpluses and it doesn’t. China runs large trade deficits with other countries to balance its exceptionally heavy dependence on trade surpluses with America. The overall trade balance demonstrates beyond reasonable doubt that America’s trade deficits with China are not the result of an undervalued yuan but of an overvalued dollar. Recent work indicates that the dollar is currently overvalued by 20-25% with respect to the rate that would give America truly balanced external trade.

What about logic? Americans and Chinese are willing partners each of whom considers theirs the best deal in the world. Who will pay the additional 10% tariff? US consumers could lose, quite substantially, and Chinese firms would lose, too, as higher prices depress demand even if the tariff is mostly paid by American consumers. So fewer Chinese companies might survive and massive job losses would cause a severe economic downturn and the trade war could cause many companies to go bankrupt, thus removing redundant capacity from the market, leaving healthy companies earning healthy returns–and one of the key Chinese government objectives just before the outbreak of trade war was to shed low-margin, low-tech, inefficient manufacturers.

How About Killing “Made in China 2025? The US has not been generous in technology transfer in the past. In fact, China is still forbidden to acquire a host of technologies the US considers strategic and still blocked from participating in projects like the ISS. The US provided a storm warning by banning sales of Intel Xeon chips to China in 2015 because they were used to power supercomputers (China released a computer powered by indigenous chips in 2016 and regained the lead). And since the ban on ZTE (a world leader in 5G intellectual property) many chip startups whose founders have technological knowhow and industrial experience but were unable to enter the supply chains of companies like ZTE, have persuaded big manufacturers to try their product and show more patience. Chances are that Chinese companies will not be starved of technology: instead our tech giants will be gradually marginalized by their Chinese competitors who would not have had such opportunities prior to the ban.

Finance all this with billions China would have invested in American tech firms and staff it with returning Chinese expat researchers/engineers discriminated against and suspected of spying under reborn McCarthyism, and Beijing could hardly be happier because, in the end, their biggest defense against a trade war is China’s market size that doubles along with wages every decade.

Can China Play Offence? China is seeking an ever-closer union with the Regional Comprehensive Economic Partnership, RCEP, between all ten ASEAN members, China, India, Japan, South Korea, Australia and New Zealand–half of the world’s population and forty percent of global GDP, thirty percent larger than NAFTA growing twice as fast. Expect to see it concluded this year. The Belt and Road Initiative already facilitates trade between seventy-three member countries that comprise two-thirds of world population and a third of the world’s nominal GDP–even without Japan and India. And BRI is negotiating to merge with the EAEU (183 million consumers and nominal GDP of $4 trillion) which Turkey and Iran have expressed interest in joining.

The world is well prepared for Washington’s withdrawal from the WTO which, given its record, will be something of a relief. Most of the tools for handling global trade without the US are in place making it likely that protectionism, unilateralism and self-imposed isolation will only demonstrate that the world can get by pretty well without us.

Reality Check. Sometime between 2020-2025, every Chinese will have a home, a job, plenty of food, education, safe streets, health and old age care. On that day there will be more homeless, poor, hungry and imprisoned people in America than in China and 450,000,000 urban Chinese will have higher net worth and more disposable income than the average American. Their mothers and infants will be less likely than ours to die in childbirth, their children will graduate from high school three years ahead of–and outlive–ours. If China wins the trade war and the world’s hearts and minds, it’s pretty much game over, almost by default.