Biden’s Actions are Behind the Collapsing Dollar

The US dollar, as the international reserve currency, has long served as an essential medium of exchange between countries with different national currencies. To fulfil this role, a reserve currency needs to be stable, safe and easily accessible to all countries. In the 20th Century, the dollar’s international status caused it to grow in value, enabling the US to bear huge levels of foreign debt.

Naturally, therefore, any report that a country disagreeing with Washington’s policies may turn to payments in its own currency instead of the US dollar is a source of undisguised alarm in the West. But now it is clear to everyone that the US dollar is losing its global position and its status as the world’s reserve currency of choice. And Washington’s inability to maintain the growth of the global economy and deglobalization are not the only causes of this phenomenon.

As the world is splitting up into different currency zones – a process that is accelerating – major powers are forced to seek investment and focus on their own economic development. Seven years ago China began to promote its own national currency, which resulted in the International Monetary Fund including the yuan in its basket of five leading currencies. Over the years many countries have begun to increase the amount of yuan in their currency reserves, scale down their use of the dollar in international transactions and create alternative payment systems. Accordingly, many central banks have begun to divest themselves of dollars, and increase their reserves of rupees, yuan, euros and gold bullion.

At the moment the members of the Eurasian Economic Union (EAEU) have reached a key stage in their bid to reduce their dependence on the US dollar, and have agreed to introduce national currencies, including the Russian ruble, into payments between member states. “This has led to the creation of a unified ruble zone,” as Maksim Reshetnikov, Russian Minister of Economic Development commented in a recent interview to the Rossiya-24 television channel. He added that the customs duties received by each country would be distributed between the member states in the proportions set out in the EAEU Treaty. In the past foreign currencies were used for this purpose, but now the EAEU national currencies, including the Russian ruble, is used.

Saudi Arabia is unhappy with the United States’ policies, and hopes to begin using the yuan for oil sales to China.

One factor that has boosted the move away from the dollar in recent weeks is the US president Joe Biden’s decision to introduce currency sanctions against Russia. India was among the countries that abstained from voting on the UN resolution condemning Russian for its special military operation in Ukraine. It was also one of the first Asian countries to feel the effect of the unprecedented economic sanctions launched by the US and its western allies against Russia. According to leading Indian media sources, the exclusion of a number of leading Russian banks from the SWIFT system led to a breakdown of payments under trading agreements between India and Russia. India is therefore working on developing ways of continuing to work with Russia under the current sanctions regime, specifically abandoning the US dollar and instead using rubles and rupees for payments between the two countries. Once in effect, this transition would have the additional advantage of allowing Delhi to purchase Russian crude oil and petroleum products at a discount. India is the world’s third largest importer of oil, and under the highly attractive terms proposed by Moscow it would be able to import up to 15 million barrels of Russian crude oil.

In addition to investing in dollars and US securities many are also diversifying their reserve funds by acquiring a range of commodities including gold bullion and raw materials. However “throughout the global economy and trading system, confidence in the US dollar’s status as the main reserve currency has suffered a serious blow,” as Russian president Vladimir Putin expressed it in a meeting on providing social and economic support to Russia’s regions on March 16. He added that the “illegitimate freezing of part of the Bank of Russia’s currency reserves has demonstrated that so-called first-class assets are no longer reliable.” “In effect the US and EU have defaulted on their obligations to Russia. Now everyone knows that financial reserves can simply be stolen, and it is my firm conviction that many countries, noting what has happened, will soon be reviewing their reserves, moving from securities and digital currency to raw materials, land, manufactured goods, gold and other physical assets,” he emphasized.

According to the US Treasury Department, the US and its allies have already signed off on the establishment of a multi-party interdepartmental group that will seek out and seize assets and take other legal measures targeted against the “Russian elite.” This new group, established as part of the sanctions pressure on Russia in response to the events in Ukraine, will include the USA, Australia, Canada, the European Commission, Germany, Italy, France, Japan and the UK, and these countries will send representatives of their Finance, Justice and Interior Ministries to participate in its activities. The official launch of the new group, known as the REPO (Russian Elites, Proxies, and Oligarchs) Task Force took place in a virtual meeting between the participating countries’ representative, including US Treasury Secretary Janet Yellen and Attorney General Merrick Garland.

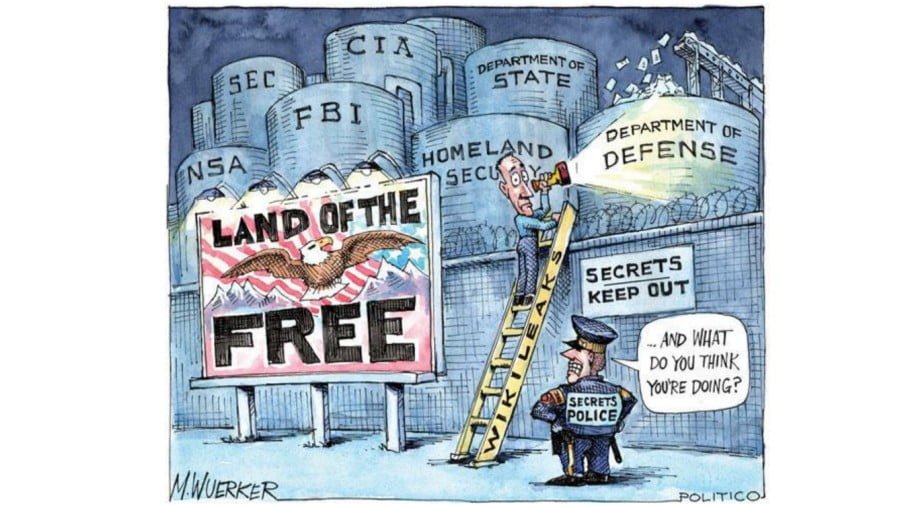

Vladimir Putin has described western sanctions of this type as a lesson for the Russian business community. “The seizure of foreign assets and bank accounts belonging to Russian companies and individuals is a lesson for our country’s business community: that the safest way to preserve assets is to keep them in our country,” he added. It is also a lesson for the international business community – since Washington’s actions have made it clear that if they decide to “go their own way” then they may also find that their bank accounts are frozen.

The German economist Henrik Müller, writing for Der Spiegel, has also suggested that the dollar may be losing its status as the leading global currency. He cited inflation, the sanctions against Russia and changes in the market among the reasons for the fall of the dollar. He also suggests that Joe Biden’s recent actions may have further damaged international confidence in the US currency. In support of his claim, he cited the fact that even in the US inflation has reached 8% – whether or not it stays at that level will depend on the measures adopted by the Federal Reserve.