The Russian-Chinese ‘Power of Siberia’ Pipeline Has Killed the Prospects for the Alaska Gas Pipeline

When Alaska’s governor Bill Walker headed with a trade delegation to China earlier this week, he must have hoped to bring back good news about an 800-mile gas pipeline project that would see the state’s gas reserves flow into an increasingly gas-hungry Chinese economy. However, the only news the delegation brought home was that Sinopec and Bank of China were still interested in the project.

This declaration of interest is hardly worth a headline, but one outtake from the meeting with Sinopec’s president, as reported by Alaska’s Energy Desk Rashah McChesney, is worth mentioning. The president of China’s largest refiner said, “After some of the work we did, in terms of assessment and evaluation in technology, economics and in terms of the resources of Sinopec — I think there’s a lot more work for us to be done than originally imagined.”

The latter part of this remark should be a cause for concern for the project’s proponents as it is a clear sign that Sinopec will be taking a cautious approach to what could be a multibillion-dollar investment.

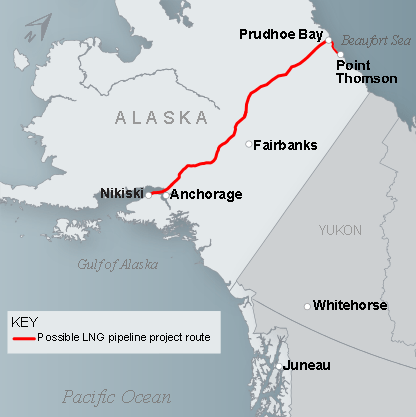

To be more precise, the pipeline will cost an estimated US$45 billion. It would ship natural gas from Prudhoe Bay to the southern Alaska coast, in Nikiski, from where the now liquefied gas will be shipped to a booming Chinese gas market. Without it, the gas is as good as non-existent, because it cannot be brought to market without a pipeline.

When Alaska’s governor Bill Walker headed with a trade delegation to China earlier this week, he must have hoped to bring back good news about an 800-mile gas pipeline project that would see the state’s gas reserves flow into an increasingly gas-hungry Chinese economy. However, the only news the delegation brought home was that Sinopec and Bank of China were still interested in the project.

This declaration of interest is hardly worth a headline, but one outtake from the meeting with Sinopec’s president, as reported by Alaska’s Energy Desk Rashah McChesney, is worth mentioning. The president of China’s largest refiner said, “After some of the work we did, in terms of assessment and evaluation in technology, economics and in terms of the resources of Sinopec — I think there’s a lot more work for us to be done than originally imagined.”

The latter part of this remark should be a cause for concern for the project’s proponents as it is a clear sign that Sinopec will be taking a cautious approach to what could be a multibillion-dollar investment.

To be more precise, the pipeline will cost an estimated US$45 billion. It would ship natural gas from Prudhoe Bay to the southern Alaska coast, in Nikiski, from where the now liquefied gas will be shipped to a booming Chinese gas market. Without it, the gas is as good as non-existent, because it cannot be brought to market without a pipeline.

Given the size of the investment that would be needed to build the infrastructure, it’s no wonder that Governor Walker reached out to potential investors in the country that would benefit from the project. He inked a preliminary deal with Sinopec, China Investment Corp., and Bank of China last November.

This, by the way, happened after the original companies behind the deal, including Exxon, BP, and ConocoPhillips, quit, worried about a surge in global LNG supplies that made the project “one of the least competitive” globally, according to Wood Mackenzie.

But Alaska is not giving up. With falling oil production and revenues, tapping the U.S.’s huge Arctic gas reserves, which estimates peg at as much as 200 trillion cubic feet, makes perfect economic sense, provided that Chinese demand lives up to the promise and there isn’t too much competition, which is doubtful, what with all the megaprojects in Australia, and Russia joining the LNG game with its eyes set mainly on Asia.

The head of the Alaska Gasline Development Corporation, Keith Meyer, said at a recent public meeting that the project will happen, despite doubts about its viability. “We’ve got some time; we’ve got some lead time, but that’s going to disappear very, very quickly,” Meyer said. “And so every person, every small company, every large company in the state has got to get ready.

Meanwhile, in addition to the doubts in both China and the U.S. about the project’s competitiveness, there is naturally environmentalist opposition to yet another pipeline. The Environmental Investigation Agency this month called on the National Marine Fisheries Service to reject AGDC’s application for approval of the pipeline project on the grounds that it will threaten a population of beluga whales in Cook Inlet, where a portion of the pipeline will pass under the seabed. The EIA has accused the company of revising its original application to reduce the extent of the threat for the endangered marine mammals.

The Sierra Club is also against it, for more general reasons such as “increased natural gas drilling in the Arctic…. increasing air pollution, diminishing wildlife habitat, and exacerbating climate change.”

The odds seem to be stacked against the Alaska gas pipeline, at least at the moment. If the Chinese investors are not yet ready to commit any actual money to the project, they might not be ready at all.

Given the size of the investment that would be needed to build the infrastructure, it’s no wonder that Governor Walker reached out to potential investors in the country that would benefit from the project. He inked a preliminary deal with Sinopec, China Investment Corp., and Bank of China last November.

This, by the way, happened after the original companies behind the deal, including Exxon, BP, and ConocoPhillips, quit, worried about a surge in global LNG supplies that made the project “one of the least competitive” globally, according to Wood Mackenzie.

But Alaska is not giving up. With falling oil production and revenues, tapping the U.S.’s huge Arctic gas reserves, which estimates peg at as much as 200 trillion cubic feet, makes perfect economic sense, provided that Chinese demand lives up to the promise and there isn’t too much competition, which is doubtful, what with all the megaprojects in Australia, and Russia joining the LNG game with its eyes set mainly on Asia.

The head of the Alaska Gasline Development Corporation, Keith Meyer, said at a recent public meeting that the project will happen, despite doubts about its viability. “We’ve got some time; we’ve got some lead time, but that’s going to disappear very, very quickly,” Meyer said. “And so every person, every small company, every large company in the state has got to get ready.

image

Meanwhile, in addition to the doubts in both China and the U.S. about the project’s competitiveness, there is naturally environmentalist opposition to yet another pipeline. The Environmental Investigation Agency this month called on the National Marine Fisheries Service to reject AGDC’s application for approval of the pipeline project on the grounds that it will threaten a population of beluga whales in Cook Inlet, where a portion of the pipeline will pass under the seabed. The EIA has accused the company of revising its original application to reduce the extent of the threat for the endangered marine mammals.

The Sierra Club is also against it, for more general reasons such as “increased natural gas drilling in the Arctic…. increasing air pollution, diminishing wildlife habitat, and exacerbating climate change.”

The odds seem to be stacked against the Alaska gas pipeline, at least at the moment. If the Chinese investors are not yet ready to commit any actual money to the project, they might not be ready at all.